Have you ever been reading an insurance policy or a medical bill and suddenly come across the word “coinsurance” and thought, wait… what does that even mean? You’re not alone.

For many people, coinsurance sounds confusing, technical, and honestly a bit intimidating at first glance.

It’s one of those terms that shows up when money and healthcare are involved, which makes it even more stressful.

But don’t worry once you understand it, coinsurance is actually pretty simple. Let’s break it down in plain English so it finally makes sense.

Quick Answer:

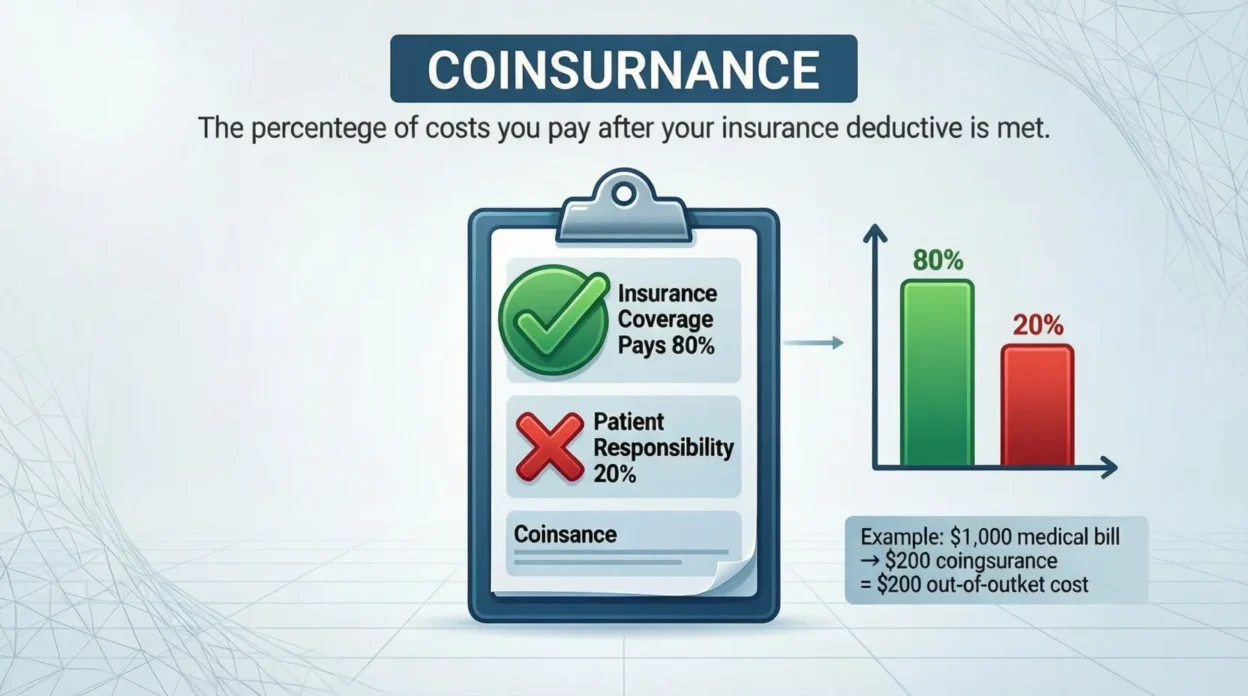

Coinsurance means sharing costs. It’s a formal, financial term used mainly in insurance to describe how you and your insurance company split expenses after your deductible is met.

🧠 What Does Coinsurance Mean in Text?

Coinsurance is not slang, it’s a real insurance term used in health, property, and other insurance policies.

In simple words, coinsurance is the percentage of costs you pay, while your insurance company pays the rest.

For example, if your policy says 20% coinsurance, that means:

- You pay 20%

- Your insurance pays 80%

👉 This usually applies after you’ve already paid your deductible.

Example sentence:

“After I met my deductible, my coinsurance was 20%, so I still had to pay part of the bill.”

In short:

Coinsurance = cost sharing = percentage you pay after deductible

📱 Where Is Coinsurance Commonly Used?

Coinsurance isn’t something you’ll see in casual texting or social media. It’s mostly used in formal and financial contexts, especially related to insurance.

You’ll commonly see it in:

- 🏥 Health insurance policies

- 📄 Medical bills

- 🏢 Property or home insurance

- 💼 Workplace benefits documents

- 📧 Emails from insurance companies

Tone & style:

- ❌ Not casual

- ❌ Not flirty

- ✅ Formal

- ✅ Professional

- ✅ Financial/legal language

Coinsurance is not slang and is not used in chats or memes.

💬 Examples of Coinsurance in Conversation

Here are some realistic, everyday examples showing how coinsurance appears in conversations usually serious or informational:

Example 1

A: “Why is the hospital bill still so high?”

B: “Because your coinsurance is 30% after the deductible.”

Example 2

A: “Does insurance cover everything?”

B: “No, you still pay coinsurance.”

🕓 When to Use and When Not to Use Coinsurance

✅ When to Use Coinsurance

- Talking about health insurance

- Explaining medical bills

- Discussing policy coverage

- Reading or writing formal documents

- Communicating with insurance providers

❌ When Not to Use Coinsurance

- Casual texting with friends

- Social media captions

- Flirting or jokes

- Informal conversations

- When explaining things to kids (use simpler words)

📊 Coinsurance Usage Comparison Table

| Context | Example Phrase | Why It Works |

| Friend Chat | “insurance makes no sense 😭 coinsurance sucks” | Informal discussion about a formal term |

| Work Chat | “Please review the coinsurance details.” | Professional & clear |

| Medical Office | “Your coinsurance is 20%.” | Accurate and standard |

| “Coinsurance applies after deductible.” | Formal and correct |

🔄 Similar Insurance Terms or Alternatives

| Term | Meaning | When to Use |

| Deductible | Amount you pay first | Before insurance pays |

| Copay | Fixed fee per visit | Doctor visits |

| Premium | Monthly payment | Keeping insurance active |

| Out-of-pocket max | Maximum you’ll pay | Cost protection |

| Coverage percentage | Insurance split | Explaining benefits |

❓ FAQs:

Is coinsurance the same as copay?

No. Copay is a fixed amount (like $20). Coinsurances is a percentage (like 20%).

Do I pay coinsurance before deductible?

Usually no. Coinsurance starts after your deductible is met.

Is coinsurance bad?

Not necessarily. Lower coinsurance usually means higher premiums, and vice versa.

Can coinsurance be 0%?

Yes. Some plans offer 0% coinsurance, meaning insurance pays everything after deductible.

Is coinsurance used in texting slang?

No. Coinsurances is not slang and is rarely used in casual texting.

Conclusion:

So, what does coinsurances mean? In simple terms, coinsurances is the percentage of medical or insurance costs you share with your insurance company after meeting your deductible.

While it may sound confusing at first, understanding coinsurances helps you avoid surprises when medical bills arrive.

Coinsurances is a formal insurance term, not slang, and is mainly used in health, property, and financial documents.

Knowing how it works empowers you to choose better insurance plans and manage your expenses smarter.

If you ever see numbers like 80/20 or 70/30, now you know that’s coinsurances in action.